Inflation is raging – clocking in at 7.9% in February.

That’s just one reason investors are flocking to gold this year.

That’s sent the SPDR Gold ETF (NYSE: GLD) up 7% YTD – versus a 6% drop for the S&P 500 ETF (NYSE: SPY).

So, you’re probably wondering…

“Should I sell blue chip stocks and BUY gold?”

Gold certainly has a place in every portfolio. Yet it isn’t a replacement for stocks. Or even the best inflation protection trade today…

Go here for my #1 trade of 2022 – it’s NOT the big tech stocks.

The #1 Inflation Trade

Inflation was 7.9% in February. And if you believe Fed Chair Jerome Powell – it’ll will drop to 4.3% by the end of the year.

Gold is one way to hedge against inflation. Yet the best and simplest inflation trade may surprise you:

BUY high quality stocks with solid earnings growth

*** Keep reading for 3 stock ideas ***

You need to scoop up stocks that are growing earnings more quickly than the rate of inflation. It’s that simple.

This means owning companies that have pricing power and can increase prices at a rate that meets or exceeds the rate of inflation.

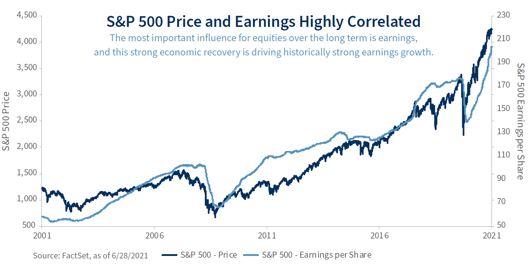

That’s important. Why? Over time, stock prices are highly correlated to earnings growth.

Just take a look at this chart…

It shows that stock prices (dark blue) move in in-line with EPS (light blue).

Wall Street analysts expect the S&P 500 to see 5% earnings growth – just slightly ahead of inflation expectations this year.

That means buying the S&P 500 could barely keep pace with inflation– especially if the Fed’s underestimating the real rate of inflation including energy and food.

To really get ahead – you’ll want to own stocks with superior earnings growth.

Here are 3 names to consider:

Deere & Co. (NYSE DE). The company manufactures equipment used in farming. With expected crop shortages this year – there’s rising demand for Deere products. Earnings are expected to grow 20% in 2022 and 14% in 2023.

Apple (NASDAQ: AAPL): The world’s largest company benefits from growing sales of smartphones, tablets, watches and services. Profits are expected to grow 9% this year and another 7% in 2023. Plus, those numbers could be even better. Apple has a long history of exceeding growth estimates.

Costco (NASDAQ: COST): The warehouse retailer continues to have a booming business as consumers look to stretch their dollars as much as possible. Earnings growth clearly exceeds inflation – including 18% growth this year and 10% in 2023.

Plus, there’s a whole new group of high growth tech stocks that are seeing explosive growth.

Frankly, buying these stocks could be like jumping into Apple, Google, or Netflix over 10 years ago.

They’re called MACE stocks.

Access my urgent LIVE webinar to discover:

- What exactly are MACE stocks – and why you have not heard of them

- When these MACE stocks could become household names

- Details on 5 of these next generation tech stocks

- How these stocks could crush FANG stocks in the next 3 years

- Why I’m planning to bet $100,000 of my personal savings on these stocks

Simply go here for urgent details.

Yours in Wealth,

Ian Wyatt

Facebook

Facebook

Twitter

Twitter